US Repo Rate Cut Impact on Crypto Markets: Tactics and Thinking to Guide Traders towards Pi42

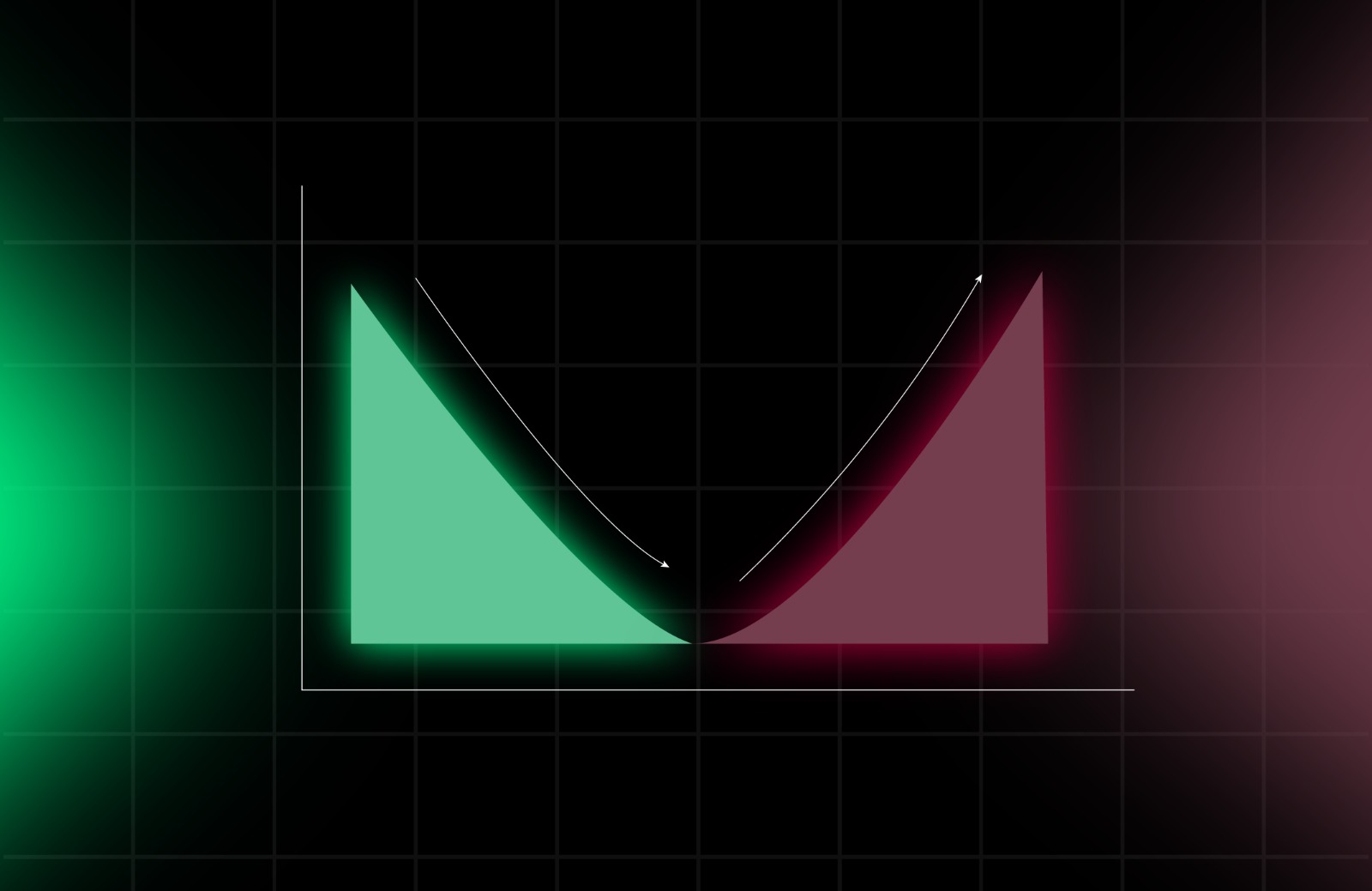

US repo rate cut: The Federal Reserve of the U.S. system cut back its repo rate by 50 basis points, bringing it to a range of 4.75% – 5%. The implications of this decision carry massive macroeconomic shifts across different markets worldwide, and the impact is felt heavily in cryptocurrencies. As an investor or trader, […]