Understanding Volume Indicators for Crypto Trading Success

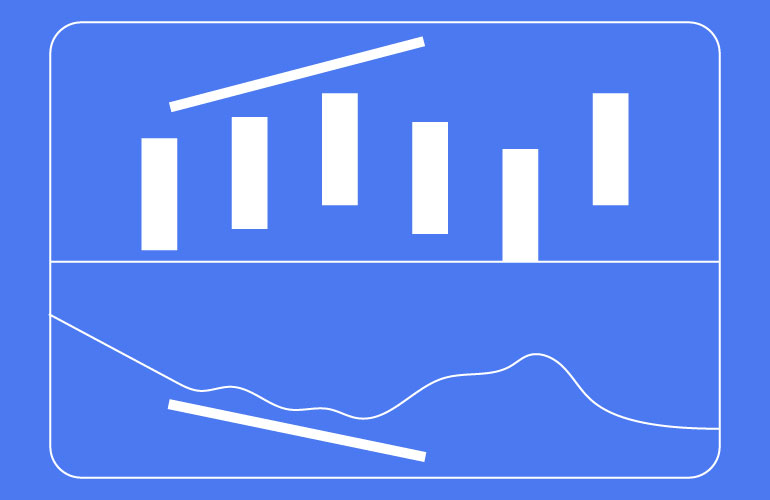

Volume plays an essential role in how markets behave. It shows how actively a cryptocurrency is being traded at any moment, giving traders a sense of the strength behind price movements. Because of this, volume indicators form an important part of every trader’s toolkit on Pi42. When used with technical analysis in crypto, these tools […]