In simple terms, market depth pertains to the information available on the supply and demand of a market at different price levels. A naive understanding of market depth would predicate this to trading decisions or strategies. The following essay seeks to expound on the importance, working mechanisms, and implications for cryptocurrency trading.

Importance of Market Depth

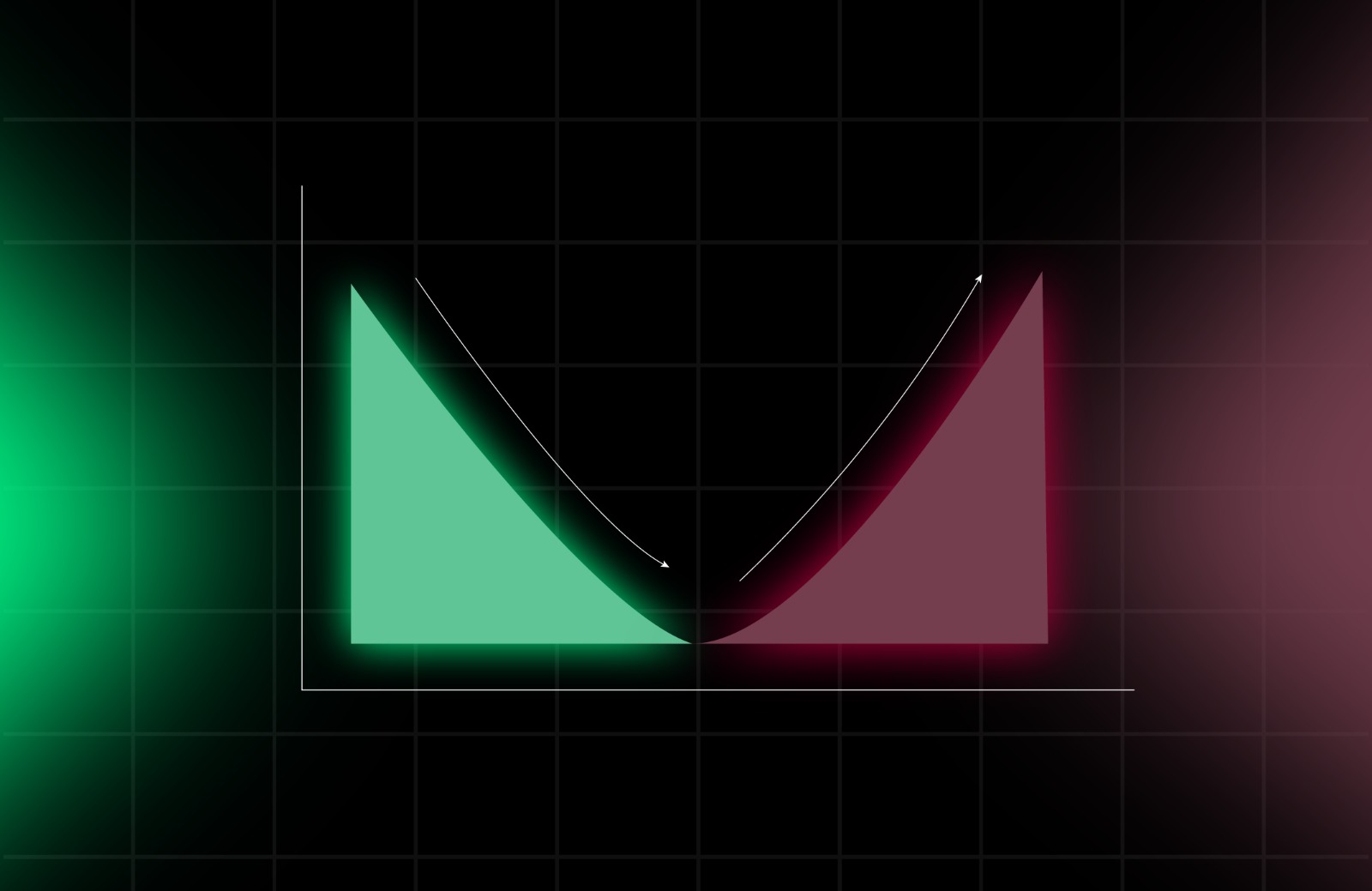

Depth of the market refers to the extent by which a market is in a position to absorb large orders before the price of that particular asset experiences a significant change. A high depth of field within a market indicates the presence of both buy and sell orders in huge amounts at different price levels; thus, it provides price stability. Low depth may cause prices to fluctuate upon the execution of relatively small trades.

Mechanisms Behind Market Depth

An order book typically exemplifies the market depth by displaying the current buy and sell orders for an asset. It is the compilation of buy orders, or bids, and sell orders, or asks, into a given point that describes liquidity in a market. A very important concept associated with market depth is the spread, referring to the difference between the best bid and the best ask. The narrower the spread, the more liquid the market; the wider, the lower the liquidity.

Impact on Cryptocurrency Trading

Cryptocurrency markets are extremely volatile, and often, the liquidity is very different on various exchanges and trading pairs. One major way traders estimate their possible actions is through the market depth. For example, if someone wants to place a large buy order in a low-depth market, he may experience huge price slippage, while placing the same order in a deep market would have little effect on the price.

It has been evidenced that liquidity providers play a very significant role in maintaining market depth. In decentralized exchanges, different programs incentivize liquidity providers to provide liquidity and hence eventually enhance the market depth and stability. Apart from that, high-frequency trading models and machine learning techniques have been invented in order to forecast market movements and further optimize trading strategy according to data regarding market depth.

Other challenges arise from the inefficiencies in the markets of cryptocurrency trading and their fragmentation. Indeed, earlier studies have proved that fragmentation could cause price differences at different exchanges and generally reduce the efficiency of trading in addition to the overall market depth.

Trends and Developments 2024

2024—Shifting Landscapes in Cryptocurrency Markets: The depth of the market is being influenced by a variety of trends within the crypto space. First, it has been gaining prominence with DeFi platforms and automated market makers, adding different dimensions to liquidity provision and therefore market depth. These are platforms for trading that use liquidity pools, and this can hugely affect the market depth and price stability.

Nowadays, advanced algorithms and artificial intelligence are more and more exploited for the analysis of market depth and predictively for price movement. Such technologies help traders make wiser decisions by giving them an insight, in real-time, into the market conditions and the potential fluctuations that might happen with the prices.

Conclusion:

One has to know the depth of the market for effective cryptocurrency trading. It aids a trader in making informed decisions, reducing price slippage, and optimising trading strategies. How to maintain and improve this market depth through liquidity provision and advanced trading models will be important for the stability and growth of the cryptocurrency market as it matures.

DISCLAIMER : Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.