Category: Tutorial

-

How to Avoid Crypto FOMO and Trade with A Cool Head?

The world of Crypto is very dynamic, and traders find Crypto trading very exciting, but most of the times are looming with the fear of Missing Out or FOMO due to high volatility. What is Crypto FOMO? Suppose you are at a social gathering with all your friends, neighbours, and relatives, discussing how they have…

-

What is High Frequency Crypto Trading? Crypto Trading 101

The cryptocurrency market is a fast-paced and ever-evolving landscape. High-frequency trading (HFT) has emerged as a dominant force within this dynamic space, utilizing sophisticated algorithms and lightning-fast execution to capitalize on fleeting market opportunities. But what exactly is HFT, and how does it impact the crypto market? Let’s understand it more deeply and explore this…

-

Short Selling vs Margin Trading – Key Differences

The world of cryptocurrency offers exciting opportunities for investors, but navigating its volatility can be tricky. Two trading strategies, short selling and margin trading, can be used to potentially amplify returns, but they also come with significant risks. Understanding these strategies is crucial before diving in. Short Selling vs Margin Trading: Key Differences Short Selling…

-

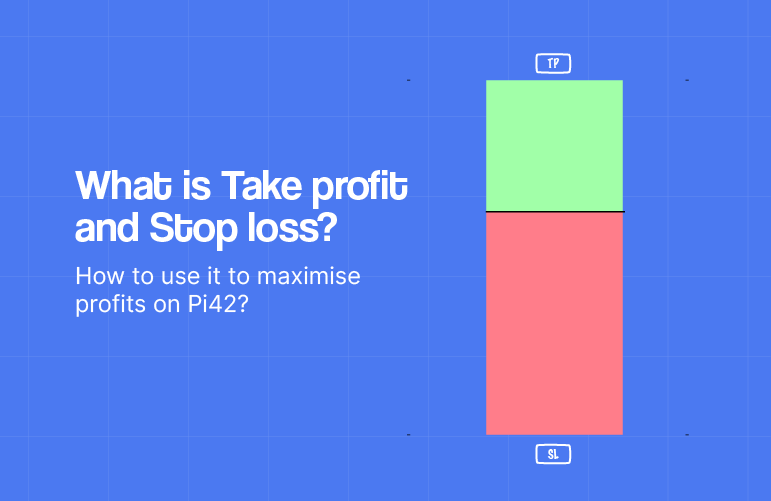

Take profit/Stop loss : How to use it to maximise profits on Pi42?

Strategic decision-making and risk management play pivotal roles in successful trades. Take Profit (TP) and Stop Loss (SL) are essential tools that empower traders to navigate the volatile market effectively. In this guide, we’ll understand the concepts of Take Profit and Stop Loss and delve into how to harness these tools to maximise profits on…

-

Scalping in crypto futures

Scalping in crypto futures is an intricate dance of timing, strategy, and discipline. While it offers the potential for quick and frequent profits, it demands a meticulous approach and a deep understanding of market dynamics. In this guide, we will demystify the concept of scalping, exploring what it entails and providing insights on how you…

-

How to Trade with Fibonacci Retracement in Crypto

Cryptocurrency trading can be both thrilling and intimidating, especially for beginners. However, there are tools and strategies that can help demystify the market, and one such powerful tool is Fibonacci retracement. In this blog, we will explore how to use Fibonacci retracement in crypto trading, breaking down the complex concepts into simple, easy-to-understand language. Understanding…

-

Crypto Futures vs. Spot Trading: Everything you need to know

The cryptocurrency market’s dynamic nature presents traders and investors with various avenues to explore. Two prominent strategies, futures trading and spot trading, offer distinct advantages and challenges. In this article we will define the key differences between these approaches, shedding light on essential considerations for understanding the crypto landscape effectively. Cryptocurrency Futures vs. Spot Trading:…

-

Mastering Crypto Futures Order Types: A Guide for Traders

Whether you’re stepping into the crypto futures market for the first time or you’re a seasoned trader, the skill of placing the right order type at the right time can significantly impact your trading journey. This essential skill is an integral part of a trader’s overall strategy. Crypto futures order types offer a spectrum of…

-

Understanding the charts and candlesticks – Crypto Futures for Beginners

The world of cryptocurrency is dynamic and fast-paced, and for beginners, navigating through the market can be challenging. One essential tool that can provide valuable insights into price movements is the use of charts and candlesticks. In this blog, we’ll break down the basics of these tools, explaining what candlesticks are, why they are the…

-

How To Use Open Interest Data For Bitcoin Crypto Future Trading?

Bitcoin futures trading is a dynamic and exciting market, but to navigate it successfully, traders need more than just price charts. Open interest data is a valuable tool that can provide insights into market sentiment and potential price movements. In this comprehensive guide, we’ll delve deeper into why open interest data is essential for Bitcoin…

-

How Much Does It Cost To Trade In Crypto Futures?

Crypto futures trading has gained immense popularity in recent years, offering traders the opportunity to profit from both rising and falling cryptocurrency prices. However, it’s essential to understand the comprehensive costs associated with trading in this volatile market. In this article, we will break down the expenses involved in crypto futures trading and explore strategies…

-

Spot Trading vs. Futures Trading

Cryptocurrency trading offers a world of opportunities, and two major paths stand out: spot trading and futures trading. Each method has distinct characteristics, presenting unique benefits and risks. In this comprehensive guide, we’ll delve deep into the realms of spot trading and futures trading, exploring their key differences, associated risks, and how futures trading aligns…

-

How to Effectively Manage Positions While Trading Crypto Futures

Crypto futures trading can be highly profitable, but it’s not without its challenges. One of the key skills that traders need to develop is the ability to manage their positions effectively. Through this article, we will explore what it means to manage positions in crypto futures trading, why it’s essential, and techniques to help you…

-

How to Calculate and Manage Funding Fees in Crypto Futures Trading

Crypto futures trading offers traders a wide range of opportunities, but it’s essential to understand and manage funding fees effectively. Funding fees, also known as the funding rate, play a crucial role in perpetual futures contracts. Our aim is to provide you with important information on what funding rates are, how to calculate them, strategies…

-

Crypto-futures trading terms for beginners

In the realm of cryptocurrency trading, few assets garner as much attention as Bitcoin (BTC). Its price movements are the stuff of legends, often leaving traders and enthusiasts alike astounded. Beneath the surface of these wild price fluctuations lies a fascinating and often misunderstood factor that can significantly impact BTC’s value: the funding rate. In…